A POS system (short for Point of Sale system) is the term used to describe the software or hardware used to facilitate the point of purchase in any business transaction, though most commonly in retail and hospitality. POS systems help streamline the payment process for both the buyer and the seller, and they have become ubiquitous over the past several years, owing to their convenience. Whether you are buying something online, over the counter, or at a market stand, you are, in all likelihood, using a POS machine. Back in the day, a POS machine was little more than a humble cash register. Nowadays, POS systems are largely digital, which enables businesses to receive payments from customers without having to lug around a heavy, clunky money drawer. In fact, all you need is an internet-enabled device - such as any smartphone or tablet - and you can download a simple and easy to use app that facilitates POS transactions. All businesses utilise POS software, but the necessity for POS hardware varies. For online stores, transactions occur on the website, eliminating the need for POS hardware. However, cafes may require a register and credit card reader, while food trucks could rely on a phone or tablet for order processing.

Technology Behind a Point Of Sale System

The comprehensive and integrated technology of a POS system allows businesses to process sales, manage inventory, track customer data, and handle various financial transactions at the point of purchase. The system enhances operational efficiency, provides real-time data insights, and offers a centralised platform for managing various aspects of business operations. Some POS systems, such as Square Point of Sale, offer the convenience of visually scanning items using your device's camera. In the case of online stores, this occurs when a customer completes the process of adding items to their cart and proceeds to click the checkout button. The POS system then computes the total cost of the selected items, accounting for any applicable taxes like GST, and updates the inventory count to reflect the sale. Your customer initiates the payment process. To complete the purchase, they can use various methods such as debit or credit cards, mobile payments, loyalty points, gift cards, or cash. The chosen payment method determines whether the customer's bank authorises the transaction. The point-of-sale transaction is then confirmed, marking the official completion of the sale. The payment is processed, generating a digital or printed receipt, and you proceed to ship or hand over the purchased items to your customer.

POS systems provide a quick and simple process that enhances the efficiency and productivity of your company, while also making things a lot easier for your customers. Read on to learn how a POS system can boost your business on a day-to-day basis.

Latest Trends in Pos Systems for 2024 & Beyond

Like any other form of technology, POS system tech is always growing and evolving. Here are some of the more notable changes that you can expect to see implemented in POS technology in the coming years…

Cloud-Based POS System

As businesses increasingly prioritise flexibility, cost efficiency, and streamlined operations, the standardisation of cloud-based POS systems is expected to continue, driven by the evolving needs of the modern business landscape. Cloud-based POS systems provide numerous advantages; users enjoy enhanced accessibility, allowing them to access data and manage operations from any location with an internet connection, and the cloud abolishes the need for extensive hardware installations, which will quickly reduce overheads. Cloud POS systems also prove cost-effective, requiring minimal upfront investment, with automatic updates ensuring ongoing efficiency. The scalability feature allows businesses to easily adjust their scale based on evolving needs without major overhauls. Data security is a priority, as cloud providers implement robust measures to ensure the safety of sensitive information. The seamless integration of cloud-based POS with other business applications enhances overall operational efficiency. Additionally, the automatic updates feature ensures that businesses receive regular software updates and feature enhancements without manual intervention, contributing to a streamlined and optimised system.

Mobile POS Solutions

Businesses worldwide have already started adopting Mobile Point of Sale solutions - or mPOS for short - and this trend is expected to keep soaring through 2024 and beyond. The best thing about mPOS is that it very easily facilitates debit, credit, and prepaid cards directly via your smartphone or tablet, anywhere, anytime, and all you need is a Wi-Fi connection (or a steady data plan). Not only is this super convenient, but it invariably needs more sales. Are you aware that customers currently pay three times more when using a credit card? Indeed, Finance Magnates estimates that by 2025, 75% of all transactions will be cashless. With mPOS, you can embrace the today, and provide your customers with a convenient, hassle-free cashless payment option.

Integration and Data Analytics

Understanding your cash flow becomes more transparent when you integrate your POS system with your company's other software platforms. This integration provides a clear overview of the cash your company generates from sales. In the past, businesses had to extract data from both their e-commerce platforms and physical POS systems, then manually combine the results into spreadsheets, accounting systems, or other reporting software. However, with shared commerce POS systems, this process is automated, saving businesses significant time. Modern POS solutions offer real-time reports and analytics, the ability to generate professional invoices, a diverse range of payment options for your customers, and more. This provides businesses with quick and convenient access to real-time data and customer insights eliminating the need to run reports on multiple systems.

POS with CRM

One of the bigger expected transformations of POS systems in 2024 is the continued development of POS with CRM (Customer Relationship Management). In contrast to earlier POS systems that could only provide minimal insights into customer behaviour, the integration of POS and CRM streamlines the process of identifying customers who significantly contribute to sales and whose loyalty is valuable for sustained pursuit, and modern POS systems seamlessly can incorporate real-time transactions with CRM systems, empowering businesses to enhance sales and revenue.

IoT & POS Security

Many newer POS systems are being built for integration with the Internet of Things (IoT), which is shorthand for the online communication of networks, devices, and physical objects that can now link POS systems to processes such as CRM, inventory, and account management. Unfortunately, this increased connectivity has led to increased vulnerability, leading to some current POS systems becoming susceptible to hacks and data breaches. But as hackers get smarter, so too must our security against them, so we will start to see IoT/POS systems with stronger, smarter security.

AI Integration

Like seemingly everything else in the contemporary age, POS has begun a move towards an artificial intelligence integration that will allow machine learning to enhance day to day POS practice. Machine learning models can now examine sales data to assist with inventory management, and by predicting demand through analysis of past sales and seasonal patterns, these models enable stores to make accurate orders, ensuring they have the right amount of inventory and prevent shortages. AI-driven POS systems can also suggest related products to customers based on their previous purchases, and analyse customer feedback to enhance products and services.

Latest POS Billing Trends

Contactless Payments - The surge of contactless payments (initially prompted by the COVID-19 pandemic) will continue well past 2024, with mobile wallets gaining popularity due to widespread smartphone usage. This allows customers to effortlessly make payments through a simple tap. POS systems are adjusting to this trend by seamlessly integrating with mobile payment options, ensuring a quicker and more secure transaction process.

BNPL - BNPL (which stands for Buy Now Pay Later) allows your consumers to buy a product and make monthly instalment payments. A POS system with instalment payment choices is well-suited for buyers lacking traditional payment options.

Omnichannel Experience - A POS omnichannel experience refers to a seamless and integrated customer shopping experience across various channels, both online and offline, facilitated by a Point of Sale (POS) system. In an omnichannel approach, customers can interact with a retailer or business through multiple touchpoints, such as physical stores, e-commerce platforms, mobile apps, and social media. The POS system plays a central role in unifying these channels, allowing customers to have consistent and cohesive interactions, access the same product information, and enjoy a seamless purchasing journey across all platforms.

Security and Compliance - Enhanced payment security measures will help safeguard both the customer's financial information as well the retailer's reputation. With features such as encrypted transactions and adherence to (Payment Card Industry) PCI compliance standards, enhanced POS security measures will offer peace of mind for both retailers and customers.

Conclusion

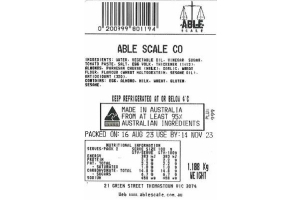

As POS systems continue to evolve into comprehensive and indispensable business solutions, sellers and consumers alike will benefit from the advancements made in contactless payments, AI-driven insights, and seamless integration with various business processes. You can make sure your business is keeping pace with the modern world by browsing Able Scale’s POS systems here. To check out our wider range, you can see our extensive line of products over at the Able Scale website. You can also get in touch with us directly here!

Have questions about our products and services?

We are here to help. Please fill in our online enquiry form below, and we will respond to you within the next business day.

Call us Today

Call us Today